WEAFs Aerospace Industry Update – May 23

Discover the latest news and developments happening in the Aerospace industry to stay relevant and keep ahead of the curve!

20-years of Aerospace Information Dissemination

WEAF was originally set up as to act as a bridge between the Primes such as GE, Rolls Royce, Leonardo and Airbus, and the lower aerospace tiers to exchange information (up & down the tiers) regarding production, MROs and the supply chain. Over the next 15-years, innovation within the aerospace industry is set to grow exponentially and we are excited by the prospect of what that may bring.

TOP TIP

WEAF can give you signposts into companies to help you get your foot through the door however, the best way to meet the professionals in the supply chain developing opportunities and innovation is through networking and face to face meetings. Action: Book onto the next WEAF event to build relationships and make advantageous connections.

The current aerospace platforms were build over 20-years ago and now we’re seeing a huge phase of innovation and development, which in turn means that there is a massive requirement for innovative new product development that will take us through the next 15-years.

WEAF envisages seeing substantial growth/cross-sector collaboration in:

- EV-TOL

- Motorsport

- Cyber-security

- Off-shore wind

- Aero dynamics

- Nuclear

- Alternative energy/fuel

These all bring a lot of overlap of skills for cross sector opportunities including the highly developed technical skills required to support the transformation of the digital revolution. This has seen four major start-ups locate in the Southwest of England due to the skills and capabilities available to them; ZeroAvia, Vertical Aerospace, Ampaire, and Aeralis.

Airbus’s ‘Wing of Tomorrow’ integrates more than 100 different component and manufacturing technologies that include an all-new industrial assembly system. The components are designed to make the best use of technologies and reduce the amount of work during the assembly phase by more than 50% supporting Airbus’ ambition to create the most highly efficient wings of the future.

Southwest is the 2nd biggest location for Aerospace in the UK

WEAF has six aerospace clusters; Cornwall, Devon, Dorset, Yeovil, Bristol & Bath, and Gloucester & Cheltenham. The expertise and companies located in the Southwest means that we are well-placed to take the aerospace industry to the next level.

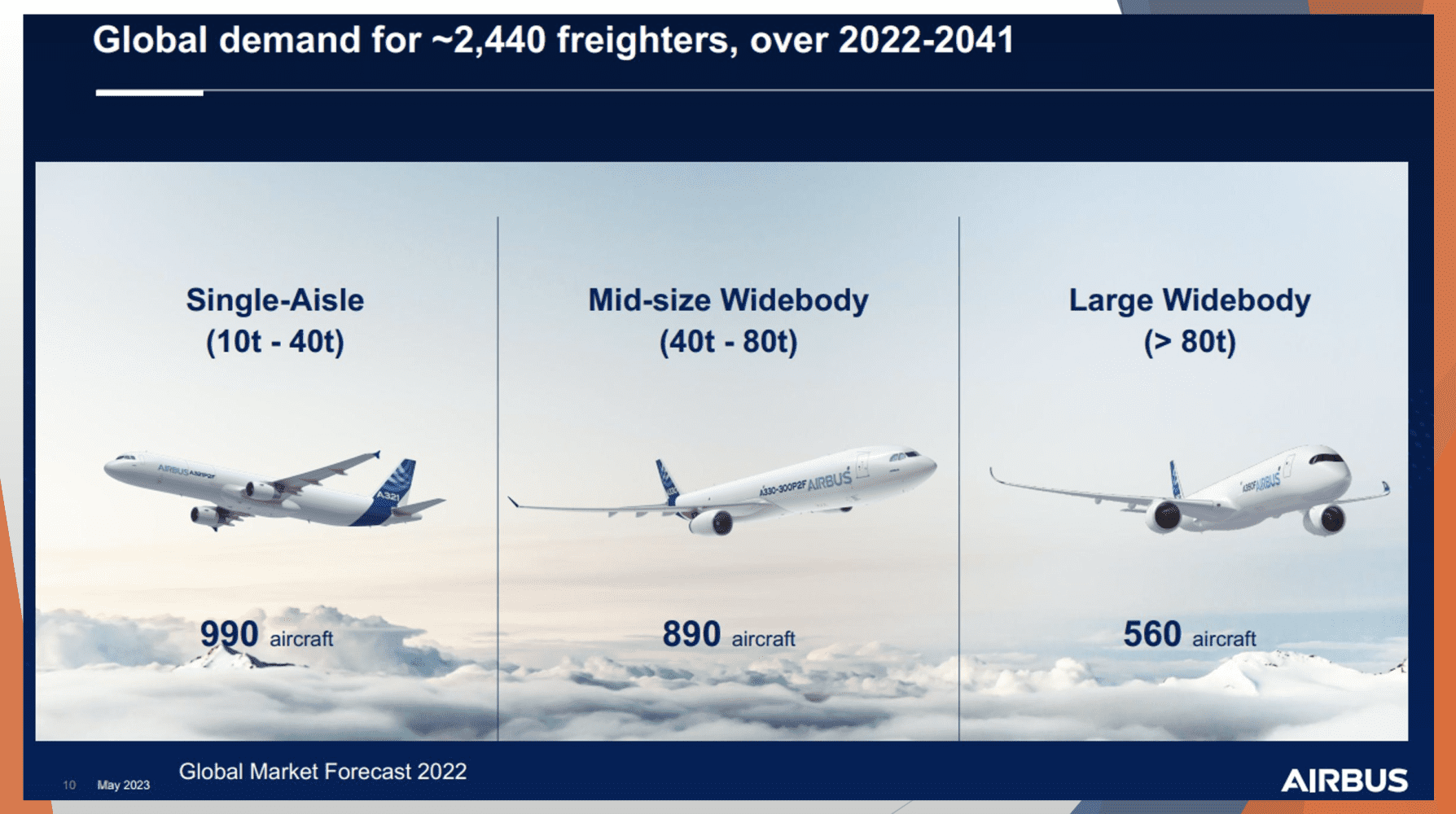

Boeing, Airbus and Membray Air are focused on developing more fuel efficient aircraft, eg. electrical systems, landing gear, materials, fuel system, and new production techniques to make the aircraft cheaper.

There is a parallel path of robust aerospace supply chains; Standard production with incremental upgrades, and Hydrogen development and testing via the likes of Airbus and Boeing outlining if and when we can use hydrogen as a fuel.

DID YOU KNOW?

The Southwest is home to over 800 supply chain companies including: wing design, engines, landing gear, avionics, fuel systems, robotics and metrology, making the Southwest the UK’s most capable aerospace cluster.

Post-Covid Recovery

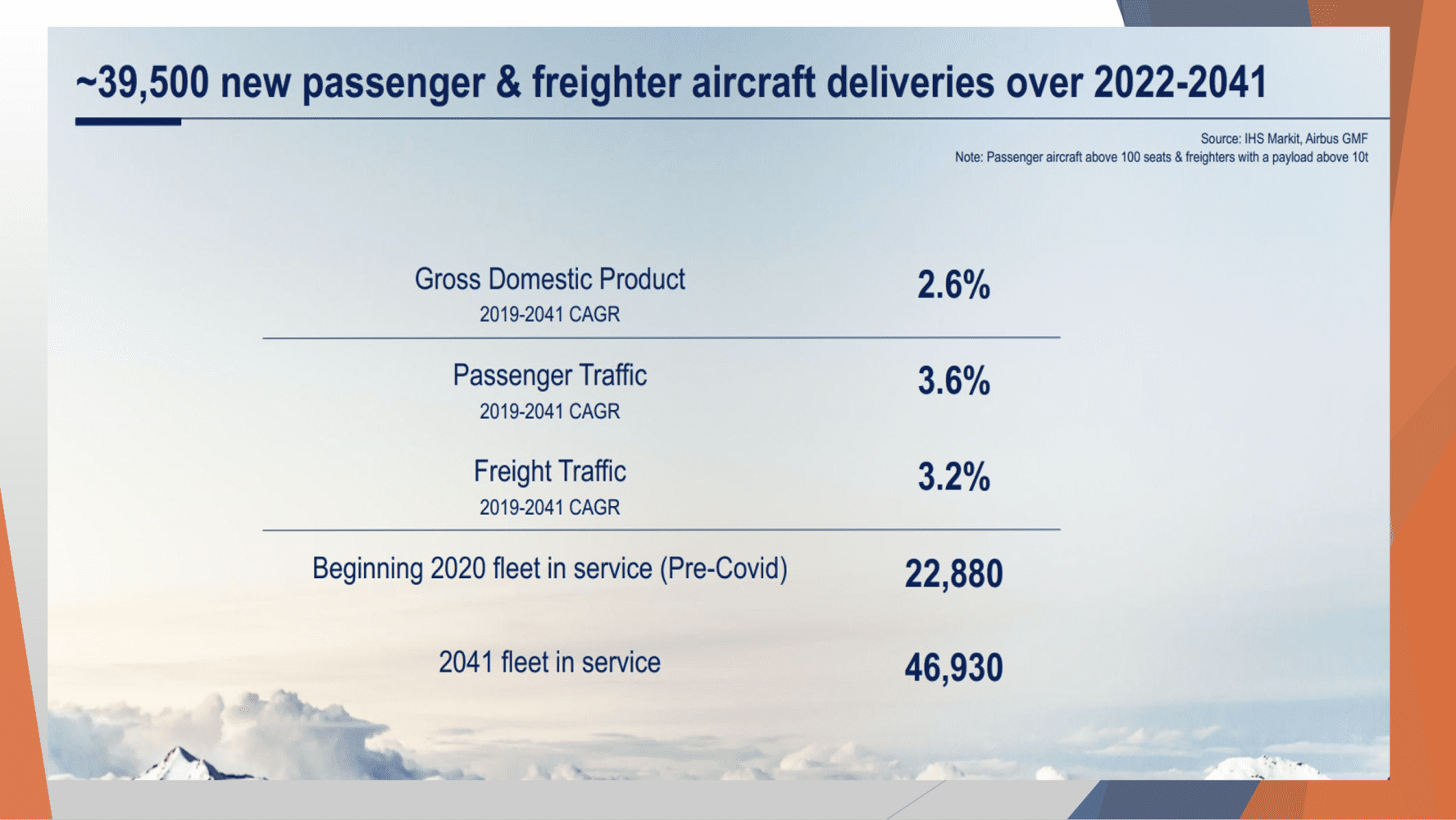

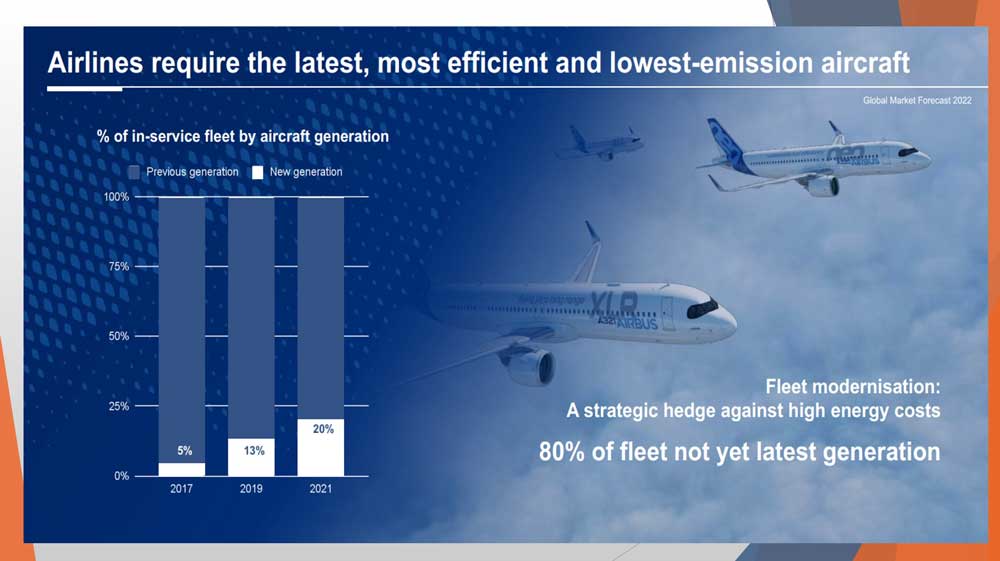

After a worldwide shutdown or the aviation industry, recovery in the aerospace industry has surprised many businesses, with demand for resources returning to pre-Covid levels by quarter 4, 2024; two years earlier than anyone was expecting! We are now on the way to a highly flexible, and recovered airline industry with many airlines starting to post profits however, there has been a large increase in fuel/energy costs (due to war in Ukraine) meaning there is now a stronger push to focus on the efficiency of aircraft.

Net Zero Goals

The Primes such as Airbus and Boeing, are predicting a robust growth following the post-covid drop off. We will see that a common goal will be sustainability and the reduction of CO2. There is a huge demand for manufacturing, engineering, designing, building etc. with the potential target of 165+ aircraft built PER MONTH by 2025! and the focus will be on the narrow body frame as this appears to be the strongest. eg. 737 Max ramp up +A220, A320 A321.

Promoting your capabilities / Search

The WEAF Network Portal now has over 7,000 users within the UK and connected to five different manufacturing networks. Heavily tested by networks and companies. This powerful digital tool is available for free to all WEAF members and will give you a massive advantage not only to promote your own capabilities, but the tailor-made taxonomies created will allow you to search for a specific capability as well eg. aircraft seats, bearings or landing gear.

COULD YOU INCREASE YOUR COMPETITIVENESS?

The WEAF Network Portal is an innovative supply chain collaboration and intelligence platform that streamlines inter-company communication and securely captures multi-tier supply chain intelligence so that organisations can increase network competitiveness. Action: Register on the WEAF Network Portal to discover collaboration opportunities and capability searches.

The future build rate for Airbus

Older aircraft will still require MRO (maintenance, repair and overhaul), meaning it will recover and grow because the fleets are flying more. What we’re also seeing is that there are still a modernisation happening. The airlines will want lower fuel burn, better capabilities which means there will be a greater demand for the Max and the Neo. The Airbus A321XLR (Extra Long Range) is going to be a major game changer in terms of passenger volume for airlines on long distance which will have a massive impact on wide-body aircraft demand. This will have implications within the supply chain as airlines will still want to be able to provide a first class element however, the A320 was designed as a mass economy aircraft so the split of economy vs business class on certain routes. This leads to a huge opportunity for the provision of aircraft interiors.

“The aviation sector is beginning to recover from the COVID-19 crisis”, said Guillaume Faury, Airbus CEO. “The message to our supplier community provides visibility to the entire industrial ecosystem to secure the necessary capabilities and be ready when market conditions call for it.”

Regardless of narrow or wide-body, there will be a push for the reduction of CO2 burn. Everything, uprated engines, light-weighting of systems, will contribute towards the fuel burn and the emissions CO2 reduction. Airlines and airline manufacturers will want to show that they are on a green, sustainable journey. We predict that the requirement to achieve sustainability will start in the next 2-3 years, so procurement sections need to ready to harness this.

The logistics support companies involved with the supply chain will be asked about their CO2 emissions/reduction which will potentially be counted as one of the KPIs through supply chain measurement, along with quality and delivery.

Substantial build rates for Airbus – 102 aircraft by 2025 – presenting huge opportunities for the supply chain:

- A220 – 14 (from 7)

- A320 – 75 (from 45)

- A330 – 2

- A350 – 6 (from 5)

REACHING THE RIGHT PEOPLE

Do your research and enter the supply chain at the lower level tiers eg. Tier 1, 2 & 3. The massive demand for new / updated aircraft means that there will be new opportunities for companies to enter the market place. Action: Contact the WEAF team to get signposting to the right connection.

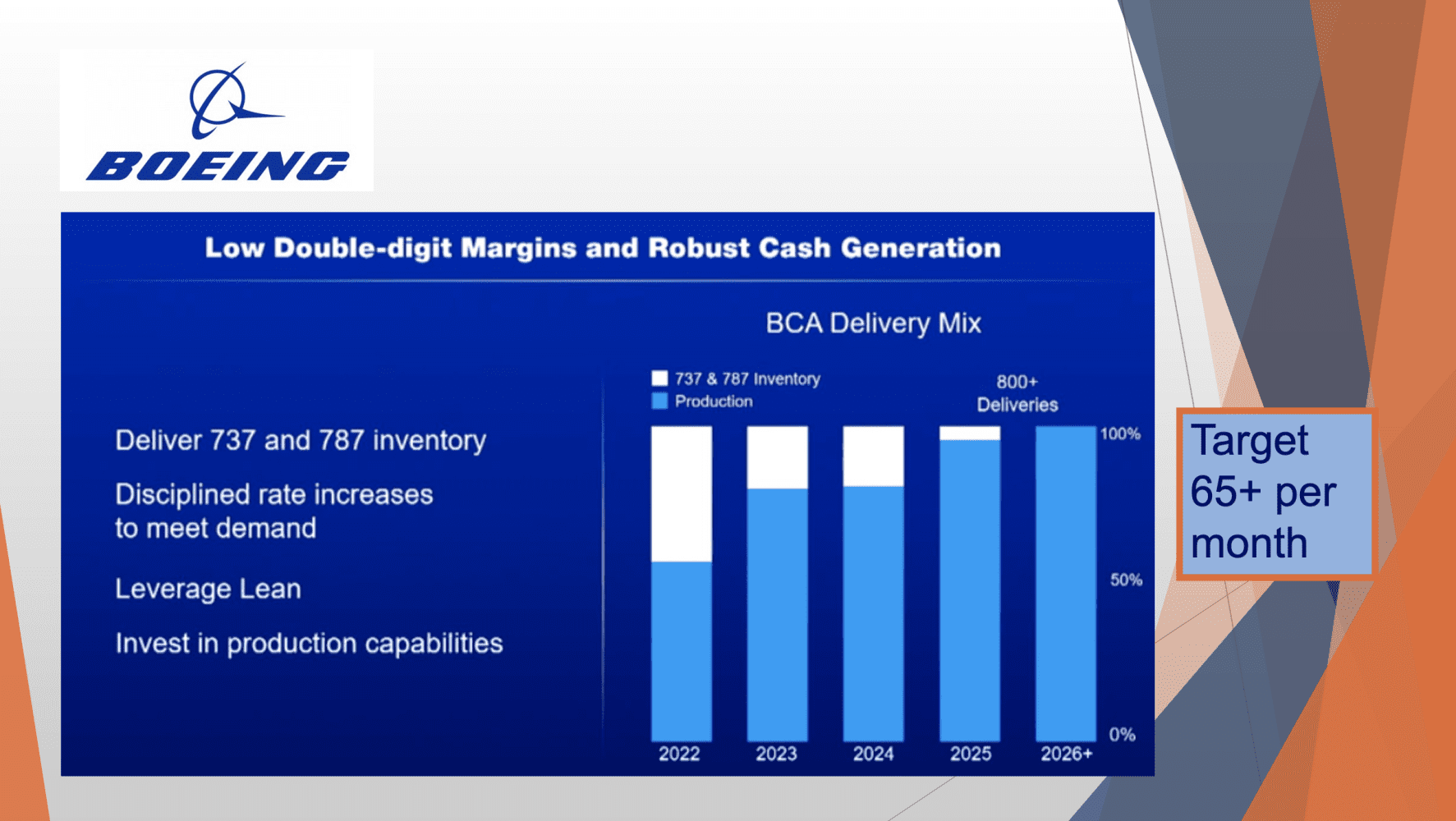

Boeing aircraft build predictions

Boeing have just signed a massive order with Ryan Air, the Chinese market is starting to take up the inventory of Max and the 787 is filtering back into the market. Single aisle aircraft is where they believe the volume will be, while developing a more fuel efficient 777 (currently delayed to watch the wide-body market so they can meet demand).

“We’ve got to be smart about how we manage supply against that demand spike,” said Boeing Co. CEO Dave Calhoun. “Progress on resolving supply chain problems has been “frustratingly slow” even as airlines’ demand for planes has bounced back to pre-pandemic levels.”

There is the potential for companies to enter the supply chain via the new work coming through (although there are elements of lag). they believe that they will be on full production by 2025 – the same time that Airbus want over 100 aircraft coming from their supply base.

Adding the Airbus and Boeing numbers together gives circa 160 aircraft per month!

WEAF anticipates seeing a stepped growth approach in delivery. The first replacing aircraft for fuel efficiency followed by airlines re-vamping over a 12-year period of aircraft in flight.

SUMMARY

The airline industry is in a large production growth spurt which is set to last the next six to eight years presenting challenges with resources throughout the supply chain.

New fuel developments

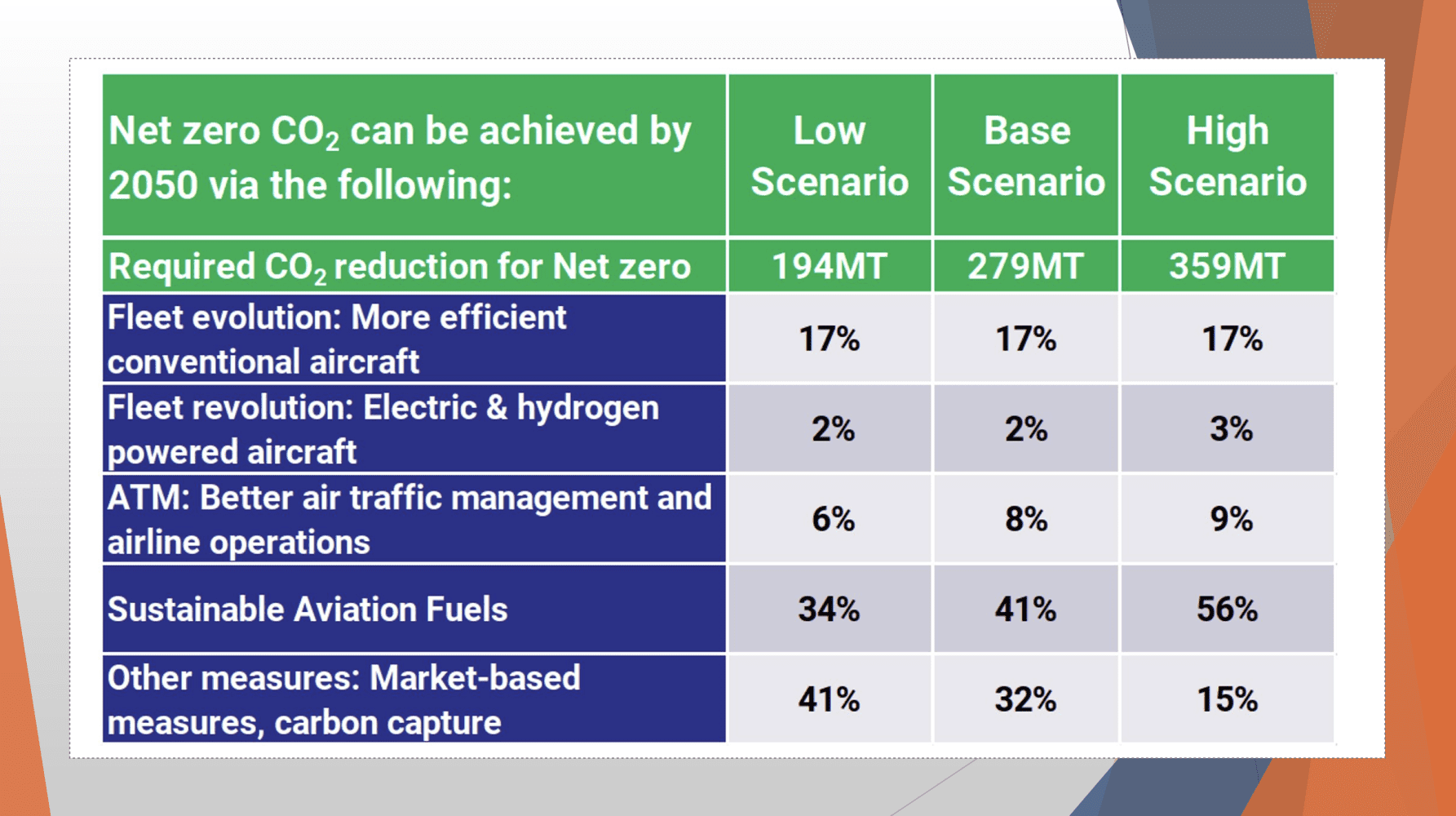

Euro Control (the organisation that looks at the infrastructure) is predicting that only 2% of civil aviation fuel used will bbee electric or hydrogen by 2050. This means that they won’t be flying huge volumes round the air system. The bulk of the aircraft will be fuelled by a derivative of aviation fuel with 41% of the aircraft burning Sustainable Aviation Fuel (SAF).

Hydrogen, at the moment, needs infrastructure and production. It can be converted very inefficiently into SAF however, you don’t have the associated costs that go with converting aircraft and the aircraft infrastructure ie. airports, to a brand new fuel. WEAF predicts that development of aircraft and aircraft infrastructure will take around 15 to 20-years.

TOP TIP

From a supply chain point of view, stick with what’s happening in development and be ready to share your capabilities without letting go of the current requirements.

Upcoming for WEAF

Somerset Innovation Network

Through the Somerset Innovation Network, WEAF is supporting the collective development, and progress of the Somerset regional innovation ambition. This means that we are giving FREE business support services for companies with an aerospace, defence or advanced manufacturing capability within the Somerset or Dorset region. Could this be your business?

NATEP-4

NATEP-3 supports the engagement and proposal development phase of the programme, as well as the technical and management mentoring throughout the project.

This mentoring and support is unique to the NATEP programme and helps companies to accelerate their technology development towards market readiness. WEAF have been involved with NATEP-3 (which is now coming to a close) and are now waiting for discussions on NATEP-4.

SC21

SC21 is a continuous improvement programme designed to accelerate the competitiveness of the aerospace and defence industries by raising the performance of its supply chains. Launching in partnership with ADS within the next 6-weeks. The enhanced SC21 programme focusses on creating a competitive advantage and helps businesses of all sizes develop the specific business capabilities required to boost competitive performance in the eyes of their customers. SC21 promisees to improve your supply chain performance with its proven industry approved capability toolset and framework. It encompasses one of the pillars of the Supply Chains Solutions Framework managed by UK trade association, ADS.

DTEP

The Defence Technology Exploitation Programme (DTEP) will be starring towards the end of the summer a will be the defence equivalent of NATEP. This £16M funding programme, running initially for 3 years, is designed to support small and medium-sized enterprises (SMEs) across the UK to develop innovative materials, technologies and processes, and to enhance defence supply chains.

DTEP aims to inspire companies to win new business, develop industrial capabilities, and provide new cutting-edge answers to defence problems at home and abroad. The programme will offer up to 50% grant funding to collaborations between UK-registered Lower Tier Suppliers and Higher Tier SuppliersDTEP aims to inspire companies to win new business, develop industrial capabilities, and provide new cutting-edge answers to defence problems at home and abroad.